Because of the economic downturn, business owners and families are looking to pawn shops for short-term loans to cover sudden financial needs. With the success of pawn-related shows on TV, many people are finding that pawn shops are clean, reputable businesses that help people from every walk of life. However, many are still uncertain as to how these Quick Loans in Chicago work. Below, readers will find some questions and answers about pawn shops and short-term loans.

What Do Pawn Shops Do?

The basis of the pawn business is to make collateral loans. The stores offer loans that are secured by a borrower’s valuables. While most pawn shops also have a retail side, their main focus is on money lending.

How Do Pawn Loans Work?

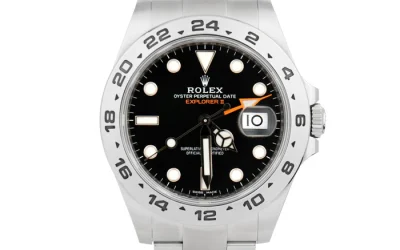

A customer brings in a valuable item and the broker offers the loan based on a portion of the item’s value. Then, the pawnbroker retains the item until the loan is repaid with fees and interest. Pawn shops are regulated at the local, state, and federal levels.

How Much Money Can a Borrower Get?

The average customer only gets a percentage of the item’s full value, because the broker is lending money, not purchasing the item. A pawnbroker must consider their costs for storage and security, as well as the item’s popularity, before offering a loan. While the average loan is for about $150, a loan can be made for almost any amount.

What Sort of Interest Rate is Involved?

Interest rates vary by location, but they’re typically less than utility reconnection fees, credit card late charges, and bank overdrafts. Quick Loans in Chicago are an easy way to avoid late fees that negatively affect a person’s credit.

How Can a Person Get a Loan?

To get a loan, all that’s needed is a valuable item and state-issued identification. Pawn loans don’t require a co-signer, bank account, or a credit check.

What Happens When Loans Aren’t Repaid?

Defaulting on a pawn loan doesn’t affect a borrower’s credit score. Because the loan is secured by collateral, it’s considered to be paid in full when the item is surrendered to the broker.

For many years, pawn shops have provided safety-net financing to those who’ve encountered sudden financial needs. These important, short-term loans aren’t found in traditional lending institutions. Visit us for more details or stop by for a loan today.